Understanding Form 8332 Rev December Form: A Comprehensive Guide

Overview of Form 8332

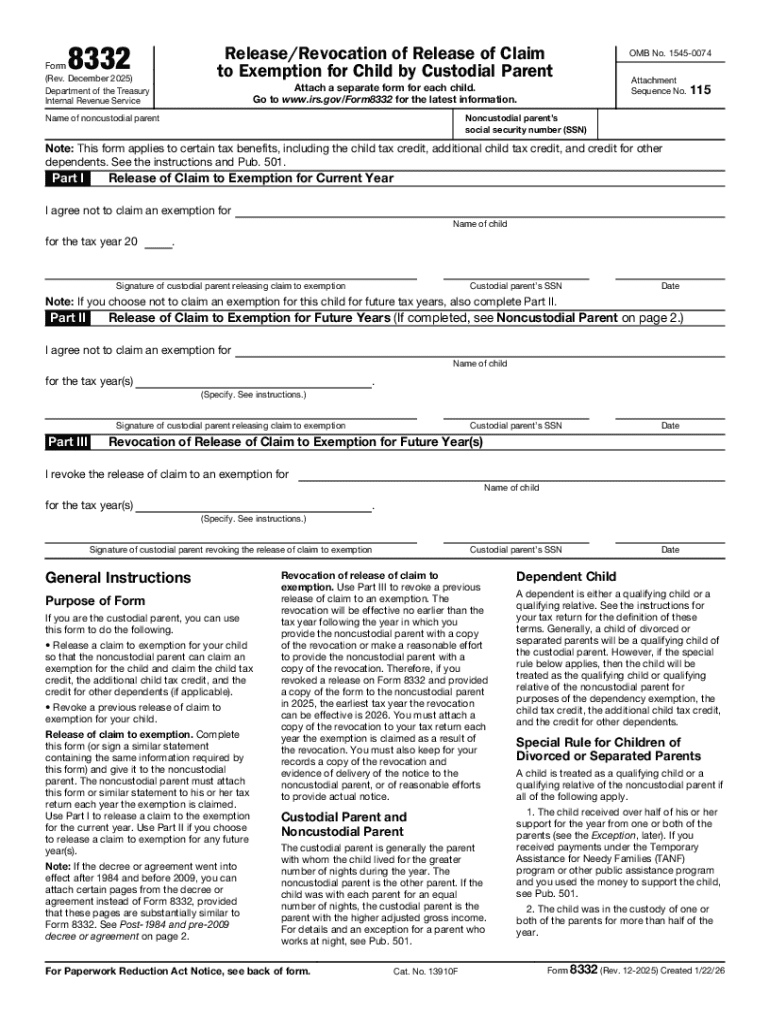

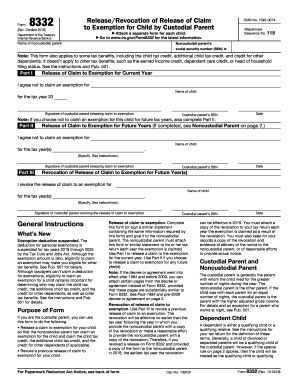

Form 8332, also referred to as the Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent, is an essential tool for divorced or separated parents. This form allows custodial parents to release their claim to a child dependency exemption, enabling the non-custodial parent to claim it instead. The significance of this form in tax filing is paramount, especially since it directly impacts the tax benefits received from the Child Tax Credit and other related deductions.

Understanding its nuances is critical for parents navigating the complexities of tax regulations following a divorce or separation. Filing Form 8332 accurately ensures compliance with IRS rules and maximizes potential tax benefits. The revised December version provides updated guidelines reflecting current tax legislation.

Who needs to use Form 8332?

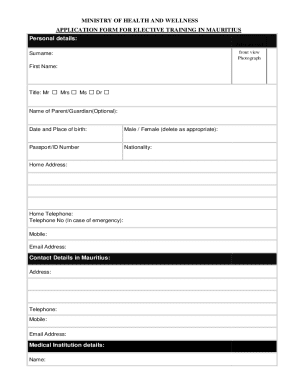

Form 8332 is specifically designed for divorced or separated parents. The need arises predominantly when parents share joint legal custody of their children but live apart. To utilize this form, one parent—the custodial parent—must agree to allow the other parent to claim the child as a dependent on their tax return.

Eligibility criteria for claiming the child tax exemption depend on several factors, including the child’s residency and the financial support provided by each parent. The custodial parent is typically the one with whom the child resides for the greater part of the year, while the non-custodial parent can claim the exemption if properly documented. Understanding the distinction between custodial and non-custodial parents is crucial for accurate tax reporting.

Detailed breakdown of Form 8332

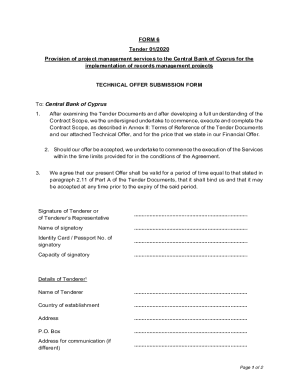

To effectively complete Form 8332, parents should familiarize themselves with its sections. Part 1 identifies the child for whom the exemption is claimed, requiring details such as the child’s name and Social Security number. Part 2 addresses the release of the claim for the specific tax year, allowing for clarity and formalization of the agreement between the parents regarding tax exemptions.

Notarization is an essential part of validating this form. The custodial parent must sign the form in the presence of a notary public, ensuring the authenticity of the release. Common mistakes include failing to provide complete information, omitting signatures, or not adhering to the notarization requirement, which can lead to issues with IRS acceptance.

Dependent exemption and child tax credit

The interplay between Form 8332 and tax benefits like the dependent exemption and child tax credit is significant. The IRS allows a dependent exemption for each qualifying child, effectively reducing taxable income, and the Child Tax Credit can provide immediate financial relief. Properly filing Form 8332 ensures that the parent claiming these benefits as a dependent qualifies under IRS regulations.

IRS guidelines dictate that only one parent can claim the child in a given tax year, and any conflicts arise must be resolved beforehand. To calculate the Child Tax Credit, it is essential to know the total number of qualifying children, the income thresholds, and any adjustments that may apply depending on the parents' tax filing status.

The process of transferring the child tax exemption

Completing Form 8332 involves a methodical approach to ensure it meets IRS standards. Begin by gathering the required information, including names, Social Security numbers, and tax years in question. Next, fill out the form accurately by following the outlined sections, paying special attention to details that denote the custodial parent’s consent for the exemption transfer.

Gather required information: Ensure you have all necessary details related to the child and both parents.

Fill out Form 8332 accurately: Double-check fields and ensure notarization is complete.

Submit the form to the IRS: Include it with the relevant tax return or as otherwise instructed.

For a seamless process, keep copies of the submitted form and any related correspondence for personal records. This is not only essential for tax documentation but also beneficial in case of disputes that may arise later.

Common scenarios involving Form 8332

Various scenarios dictate the need for Form 8332. In cases of single versus joint custody, the custodial parent typically holds the right to claim the exemption unless explicitly agreed otherwise. However, complications arise when one parent refuses to sign the form. In such cases, both parents must return to their divorce decree or custody arrangement to determine how exemptions should be handled.

Handling disputes and potential IRS audits concerning Form 8332 can be complex. It's vital for parents to communicate openly during the tax preparation season to avoid claims that could trigger an audit. Keeping meticulous records of agreements and the form's submission can aid in substantiating claims made for child exemptions.

State-specific considerations

Understanding state-specific laws related to Form 8332 is crucial as they can vary significantly. For example, Washington D.C. has its unique tax regulations that affect how dependency exemptions are handled. Parents need to be aware of state child tax credits and how these may align or differ from federal guidelines.

Additionally, some states may have distinct requirements regarding how parents must file for child dependency claims. This could include varying documentation or adjustments based on local tax laws, emphasizing the need to consult with a tax professional or review state-specific regulations when preparing your tax return.

Alternatives to Form 8332

While Form 8332 is essential for transferring tax exemptions between parents, there are other forms relevant to child dependency claims. Parents should also consider filing Form 8812, which pertains to the Additional Child Tax Credit, especially for lower-income households, and Form 8862 for those who have previously lost tax credits.

Exploring additional deductions available to parents will help maximize tax savings. It is beneficial to keep abreast of the latest tax reforms and guidelines to ensure all opportunities for financial relief are leveraged effectively.

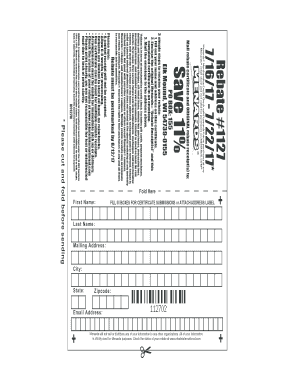

Managing your documents efficiently

Utilizing tools like pdfFiller for managing Form 8332 and other related documents enhances efficiency. pdfFiller allows users to edit PDFs, e-sign, and securely share files, making it a valuable resource for parents navigating tax forms. The platform provides ease of use, allowing comprehensive management of tax documentation without the hassle of traditional paper filing.

Moreover, pdfFiller’s cloud-based system ensures that important documents, such as Form 8332 and supporting tax records, are accessible from anywhere. This capability is particularly beneficial during tax season when multiple forms and deadlines converge.

Best practices for keeping tax records

Maintaining organized tax records is vital for compliance and future reference. Parents should retain Form 8332 and all associated tax documents for at least three years, based on IRS recommendations. A recommended filing system includes keeping electronic copies in addition to physical records to ensure redundancy.

How long to keep Form 8332 and tax documents: At least three years from the date of filing.

Recommended filing systems for parents: Organize documents by year and category (income, exemptions, deductions).

Periodic review of tax documents for accuracy: Schedule regular check-ins to update and confirm tax-related documents.

A thorough record maintenance routine mitigates risks during audits and provides peace of mind, knowing that all documentation is in order should the IRS require it.